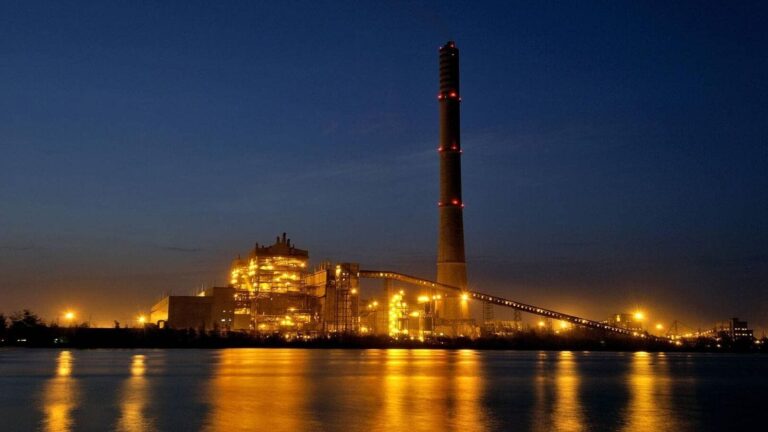

Sebi Cracks Down on Gensol Engineering: Major Investigations and Regulatory Turmoil Unfold

Gensol Engineering Under Scrutiny as Regulatory Authorities Investigate Alleged Corporate Misconduct

New Delhi: The corporate landscape in India is abuzz with developments surrounding Gensol Engineering, a prominent player in the renewable energy sector. Recent meetings at the highest levels of regulatory authorities indicate a focused crackdown on the company regarding serious allegations of fraud and corporate governance lapses.

The Regulatory Spotlight on Gensol Engineering

Securities and Exchange Board of India (SEBI) Chairman Tuhin Kanta Pandey recently met with Corporate Affairs Secretary Deepti Gaur Mukerjee to discuss ongoing investigations involving Gensol Engineering. This meeting took place amid a wave of regulatory scrutiny targeting Gensol and its promoters, brothers Anmol and Puneet Jaggi.

Last month, SEBI took a significant step by barring the Jaggi brothers from accessing the securities market. The regulator mandated a forensic audit of Gensol after an interim report highlighted red flags related to fund diversions and corporate governance failures.

Key Allegations Against Gensol Engineering

The investigations into Gensol Engineering are multifaceted and serious. Here are the key points:

- Fund Diversion Claims: The Jaggi brothers are accused of misappropriating funds and diverting them from their intended purpose.

- Loan Misuse: Allegations have surfaced regarding the misuse of term loans from state-run institutions, such as the Indian Renewable Energy Development Agency (IREDA) and Power Finance Corporation (PFC).

- Forensic Audit: A forensic audit has been ordered to scrutinize the financial activities of Gensol and assess the legitimacy of transactions reported in their financial statements.

Corporate Affairs Ministry Gets Involved

Alongside SEBI’s investigation, the Ministry of Corporate Affairs (MCA) has initiated a separate probe into Gensol and 18 related entities, including the electric vehicle service provider BluSmart Mobility. This comprehensive inquiry is set to conclude within 3 to 5 months, according to a senior official involved in the investigation.

As part of this wider investigation, the National Financial Reporting Authority (NFRA) has launched a preliminary inquiry into Gensol’s financial records. Additionally, the Institute of Chartered Accountants of India (ICAI) is reviewing the FY24 financial statements and statutory audit reports from both Gensol and BluSmart Mobility, which could reveal further discrepancies or regulatory violations.

Market Reactions and Financial Impact

Gensol’s stock market performance illustrates the company’s troubled situation. In the previous fiscal year, shares reached a high of ₹1,126, resulting in a market capitalization of around ₹4,300 crore. However, following the heightening scandal, the stock price plummeted to ₹133 by April 11, 2025, just days before SEBI released its interim report, cutting the market cap down to a mere ₹506 crore. On the latest trading day, Gensol’s shares closed at ₹65.50, reflecting a decrease of 2% from the previous close.

Ongoing Investigation and Future Implications

As investigations intensify, questions loom over corporate governance and ethics within Gensol Engineering. This situation presents critical implications for other companies in the renewable energy sector and may set a precedent for regulatory practices in India.

- Implications for Shareholders: Current shareholders may face significant losses as the integrity of Gensol’s financial practices is questioned.

- Reputation on the Line: The reputation of Gensol Engineering could endure long-lasting damage, affecting future partnerships and investment opportunities.

- Regulatory Oversight: This case underscores the importance of stringent regulatory frameworks and robust corporate governance measures in ensuring market integrity.

Conclusion

The ongoing investigations into Gensol Engineering highlight significant issues regarding corporate governance and ethical business practices in India. With both SEBI and the MCA actively engaged in scrutinizing the allegations against the Jaggi brothers, the outcomes of these inquiries could have far-reaching implications for the renewable energy sector and the corporate landscape at large. As the regulatory environment continues to evolve, maintaining transparency and accountability in corporate actions will be paramount to restoring stakeholder trust and safeguarding market integrity.

For investors and stakeholders, staying abreast of these developments is more important than ever as the repercussions of this ongoing investigation unfold.

![<pre>PayloadTooLargeError: request entity too large<br> at readStream (/var/app/current/node_modules/raw-body/index.js:163:17)<br> at getRawBody (/var/app/current/node_modules/raw-body/index.js:116:12)<br> at read (/var/app/current/node_modules/body-parser/lib/read.js:79:3)<br> at jsonParser (/var/app/current/node_modules/body-parser/lib/types/json.js:138:5)<br> at Layer.handle [as handle_request] (/var/app/current/node_modules/express/lib/router/layer.js:95:5)<br> at trim_prefix (/var/app/current/node_modules/express/lib/router/index.js:328:13)<br> at /var/app/current/node_modules/express/lib/router/index.js:286:9<br> at Function.process_params (/var/app/current/node_modules/express/lib/router/index.js:346:12)<br> at next (/var/app/current/node_modules/express/lib/router/index.js:280:10)<br> at expressInit (/var/app/current/node_modules/express/lib/middleware/init.js:40:5)</pre>](https://ouat.co.in/wp-content/uploads/2025/07/a-mumbai-local-passenger-shared-a-video-of-a-massive-crowd-on-reddit-06195993-16x9_0-768x432.jpg)